Market segmentation has become a forgotten skill for marketers.

Over the last few years I’ve helped dozens of SME brands with their strategic planning but I can count on one hand how many of these brands had good market segmentation, and that’s a problem, as strategic and tactical choices will be missing essential data interpretations to guide decisions on objectives, messages, media channels, new product development and so on.

Whilst market segmentation is somewhat of an imprecise skill, when done well, it helps mitigate risk and avoids wasteful ‘spray and pray’ marketing, which for SMEs with limited budgets, is critical.

Good segmentation should provide an overview of where your brand could play in the category by dividing it into clusters (using shared audience characteristics) which provide some clarity on how meaningful and actionable each segment is for your brand, but with a basic minimum detail of:

- A/B variables shared by each segment

- Estimated size/value of each segment

- Estimated growth for each segment

- Your market share of each segment

In isolation of any data variables, creating customer personas does not constitute market segmentation. Typically, the personas I see are rooted in stereotypes and assumptions, created by poorly trained marketers or agencies in a lazy attempt at developing some sort of strategy.

Similarly, using Millennials, Boomers, and Gen-Zs does not constitute market segmentation. They are generational cohorts who think and behave very differently from one another, so treating them as a market segment is pointless as they are simply too broad.

Good segmentation will combine variables to avoid being too broad or to narrow:

Demographic variables include age, gender, geographic locations, income etc.

Firmographic variables include industry sector, no. of employees, turnover etc.

Behavioural variables include purchasing habits, patterns, and behaviours etc.

Psychographic variables include attitudes, interests, beliefs, and lifestyles etc.

Use the simple checklist below to keep your segmentation meaningful:

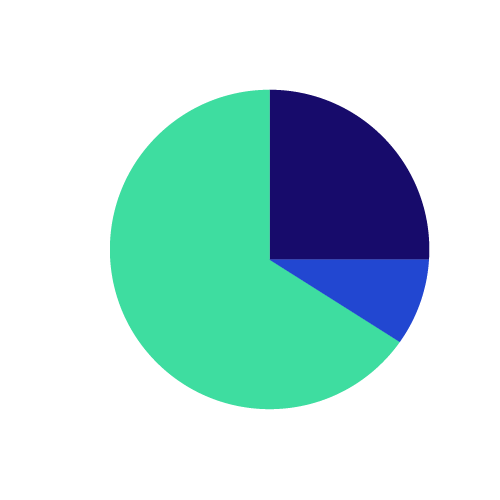

- The combined value/volume of your segments should roughly equal the total category size. If not, find and add the missing segments to enable targeting choices later on in your strategy.

- Customers should not be identifiable in more than one segment. If they are, revisit the segments to make them tighter and more exclusive.

- Segment names should be obvious and based on your customer attitudes and behaviours. Ask your team what they think a segment name means, if they can’t guess correctly, have a rethink.

- You should be able to identify actual customer examples for each of your segments. Run a quick ‘n’ dirty test to map a few customers into each segment to ensure they match up.